Onboarding women to financial services

Onboarding women to financial services

Clients: BRAC / Bill & Melinda Gates Foundation

Clients: BRAC / Bill & Melinda Gates Foundation

Clients: BRAC / Bill & Melinda Gates Foundation

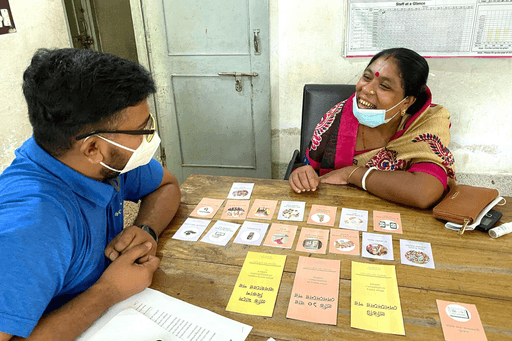

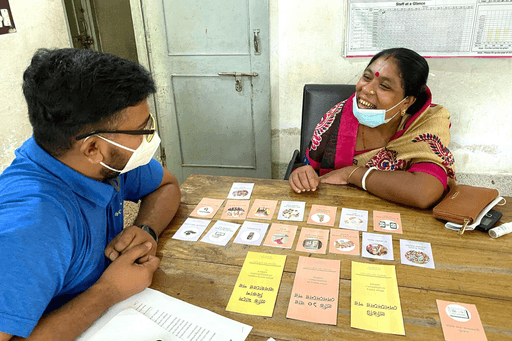

Prototyping Magic

Prototyping Magic

Prototyping Magic

Context:

In 2020, Shalu led IDEO.org’s team to partner with BRAC’s Social Innovation Lab and bKash to onboard women to mobile and digital financial services in rural Bangladesh. BRAC was looking to build the pipeline of women who could start using their microfinance services, and bKash was looking to build a new user customer segment among rural low-income women. The team built BRAC Shakti, an incentive program that boosts women’s confidence with digital financial services (DFS) by surrounding them with a peer group so they can explore, learn, and gain comfort with digital tools.

Collaboration:

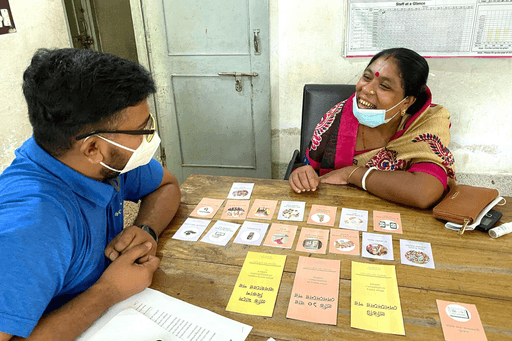

This collaboration was equal parts capacity building and solution building. Taking place in the middle of the covid-19 pandemic, the IDEO.org team had to remote coach the BRAC team to conduct design research, remotely synthesize learnings, and while the Bangladesh-based team slept, the US-based team built prototypes for the team to take to communities the next day.

As the team identified the right model to build digital confidence and comfort with financial products, they tested individual goal-based savings activities, as well as group based models. Overwhelmingly, women preferred the group based model. Groups felt like a safe space to fail and learn, rather than being isolated on the journey. As a result, the team designed a group-based learning and incentive model, where a large component of the engagement was social.

Context:

In 2020, Shalu led IDEO.org’s team to partner with BRAC’s Social Innovation Lab and bKash to onboard women to mobile and digital financial services in rural Bangladesh. BRAC was looking to build the pipeline of women who could start using their microfinance services, and bKash was looking to build a new user customer segment among rural low-income women. The team built BRAC Shakti, an incentive program that boosts women’s confidence with digital financial services (DFS) by surrounding them with a peer group so they can explore, learn, and gain comfort with digital tools.

Collaboration:

This collaboration was equal parts capacity building and solution building. Taking place in the middle of the covid-19 pandemic, the IDEO.org team had to remote coach the BRAC team to conduct design research, remotely synthesize learnings, and while the Bangladesh-based team slept, the US-based team built prototypes for the team to take to communities the next day.

As the team identified the right model to build digital confidence and comfort with financial products, they tested individual goal-based savings activities, as well as group based models. Overwhelmingly, women preferred the group based model. Groups felt like a safe space to fail and learn, rather than being isolated on the journey. As a result, the team designed a group-based learning and incentive model, where a large component of the engagement was social.

Context:

In 2020, Shalu led IDEO.org’s team to partner with BRAC’s Social Innovation Lab and bKash to onboard women to mobile and digital financial services in rural Bangladesh. BRAC was looking to build the pipeline of women who could start using their microfinance services, and bKash was looking to build a new user customer segment among rural low-income women. The team built BRAC Shakti, an incentive program that boosts women’s confidence with digital financial services (DFS) by surrounding them with a peer group so they can explore, learn, and gain comfort with digital tools.

Collaboration:

This collaboration was equal parts capacity building and solution building. Taking place in the middle of the covid-19 pandemic, the IDEO.org team had to remote coach the BRAC team to conduct design research, remotely synthesize learnings, and while the Bangladesh-based team slept, the US-based team built prototypes for the team to take to communities the next day.

As the team identified the right model to build digital confidence and comfort with financial products, they tested individual goal-based savings activities, as well as group based models. Overwhelmingly, women preferred the group based model. Groups felt like a safe space to fail and learn, rather than being isolated on the journey. As a result, the team designed a group-based learning and incentive model, where a large component of the engagement was social.